Equity Explained: How NYC Real Estate Investors Can Build, Track, and Use Equity Like a Pro

- gary wang

- Apr 21, 2025

- 4 min read

If you're new to real estate investing in NYC, you’ve probably heard the word equity tossed around. But what exactly does it mean—and why is it so important to your investing journey?

In simple terms, equity is your ownership stake in a property. It’s the difference between the property’s current market value and how much you still owe on your mortgage. Over time, as the value of your property increases and your debt decreases, your equity grows—and so does your net worth.

In high-value markets like New York City, equity can be a powerful source of wealth if you know how to harness it.

What Is Equity in Real Estate? A Simple Breakdown

Let’s say you purchase a condo in Astoria, Queens for $800,000. You put down 20% ($160,000), and your mortgage covers the remaining $640,000.

A few years later, the market value of your condo rises to $950,000, and you've paid down your mortgage to $600,000.

Your equity = $950,000 (current value) – $600,000 (loan balance) = $350,000

That $350K is your equity—your portion of ownership. It’s what you’d pocket (before taxes and closing costs) if you sold the property today.

Why Equity Matters in NYC’s Competitive Real Estate Market

In NYC, where home prices are high and rising, equity can build surprisingly fast. Here’s why it matters:

✅ It Represents Real Wealth

Equity is one of the few ways everyday people build long-term wealth. It’s not just “theoretical money”—you can borrow against it, reinvest it, or cash it out.

✅ You Can Leverage It for More Investments

Many NYC investors use their home equity to buy additional properties, renovate, or consolidate high-interest debt.

✅ It Grows While You Sleep

As property values rise (a common trend in neighborhoods like Park Slope, Washington Heights, and Long Island City), your equity increases—without you lifting a finger.

✅ It Provides a Buffer for Real Estate Downturns

Markets fluctuate, and NYC isn’t immune to price dips. Having strong equity gives you a financial cushion if the market corrects or rental income slows.

If property values drop temporarily, having substantial equity reduces your risk of going “underwater” (owing more than the property is worth), and gives you more flexibility to hold, refinance, or weather economic changes without panic-selling.

How to Build Equity in NYC Real Estate

Here are several ways to grow your equity over time:

1. Property Appreciation

NYC real estate tends to appreciate thanks to high demand and limited space. Even modest annual appreciation (say 3–5%) can result in tens or hundreds of thousands in equity gains over time.

Example: A $1M property appreciating at 5% annually grows in value by $50K each year.

2. Paying Down Your Mortgage

Every mortgage payment includes principal (which reduces your loan balance) and interest. The more you pay toward principal, the faster you grow equity.

Pro Tip: Make biweekly mortgage payments instead of monthly to shave years off your loan and increase equity faster.

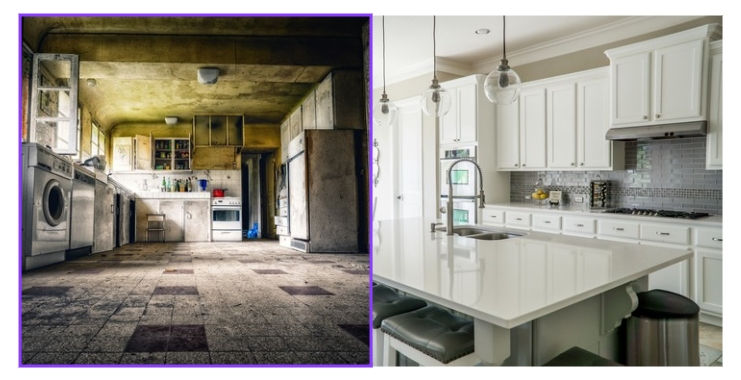

3. Renovate to Add Value

Strategic renovations can immediately increase your property’s value—and thus your equity. In NYC, buyers and renters pay a premium for updated kitchens, bathrooms, and smart layouts.

How to Tap Into Your Equity Without Selling

One of the best things about equity? You don’t have to sell your property to benefit from it. Here are two common ways to access your equity while keeping your NYC asset:

🔁 Cash-Out Refinance

You replace your existing mortgage with a larger one and take the difference in cash. This is ideal if interest rates are still favorable.

Example: Refinance from $500K to $600K, take $100K in cash, and use it to invest in another property.

🏦 Home Equity Line of Credit (HELOC)

A HELOC works like a credit card with your equity as collateral. You only pay interest on what you borrow.

This is great for funding renovations or down payments on new investments.

How Equity Plays a Crucial Role in 1031 Exchanges

If you're planning to grow your real estate portfolio and defer taxes, a 1031 exchange (also called a like-kind exchange) is one of the most powerful tools available to NYC real estate investors. And equity? It's the engine that powers it.

🔁 What Is a 1031 Exchange?

A 1031 exchange allows you to sell one investment property and reinvest the proceeds into another like-kind property—without paying capital gains taxes right away.

The key? You must reinvest the entire amount of your equity into a new property to fully defer taxes.

💡 Tip for NYC Investors:

Because NYC properties tend to appreciate significantly over time, most investors have substantial equity locked up—making 1031 exchanges a smart strategy to:

Trade into larger, more profitable properties

Diversify into other boroughs or even out-of-state markets

Increase cash flow while deferring taxes

Tracking and Managing Your Equity

Keep an eye on your equity so you know when it makes sense to refinance, sell, or reinvest.

Create a comparable market analysis

Check mortgage statements regularly to monitor loan balance

Use a spreadsheet or app to track your growing equity

Final Thoughts: Build Equity, Build Wealth

Equity is more than just a number—it’s your financial foundation as a real estate investor. Whether you're planning to refinance, reinvest, or complete a 1031 exchange, understanding how to track and grow your equity is key to building long-term wealth in NYC real estate.

This blog post is provided for informational purposes only and should not be construed as financial, legal, or investment advice. While I am a licensed real estate professional in New York, I am not a financial advisor, attorney, or tax professional. Readers are strongly encouraged to consult with their own licensed attorney, CPA, or financial advisor before making any real estate investment decisions. All information is deemed reliable but not guaranteed and is subject to change based on market conditions, legal updates, or individual deal circumstances.

Comments