Understanding Capitalization Rate (Cap Rate) in Real Estate Investment

- gary wang

- Apr 3, 2025

- 4 min read

Updated: Apr 15, 2025

What is the Capitalization Rate (Cap Rate) in Real Estate Investing?

The capitalization rate (cap rate) is a fundamental metric in real estate investing that helps investors assess the potential return and risk of an income-generating property. Understanding cap rates can guide real estate investors, property developers, and commercial real estate professionals in making informed decisions about their property acquisitions.

What is Cap Rate & How is It Calculated?

The cap rate is calculated using the following formula:

Cap Rate = Net Operating Income (NOI) / Purchase Price

The cap rate measures the annual return on an investment before factoring in financing costs. A higher cap rate generally indicates a higher risk and potentially higher returns, while a lower cap rate suggests stability and lower risk. This metric is most effective when comparing similar asset classes, such as multifamily properties to other multifamily properties or commercial buildings to similar commercial properties.

Cap Rate Calculation Example

Scenario:

Net Operating Income (NOI): $50,000 per year

Purchase Price: $800,000

Calculation:

Cap Rate = $50,000 / $800,000 = 6.25%

In this case, the investor can expect a 6.25% annual return before accounting for mortgage payments or additional expenses.

How to Ensure Accurate Cap Rate Calculations

To make sound real estate investment decisions, it is critical to ensure the accuracy of your cap rate calculation by considering the following factors:

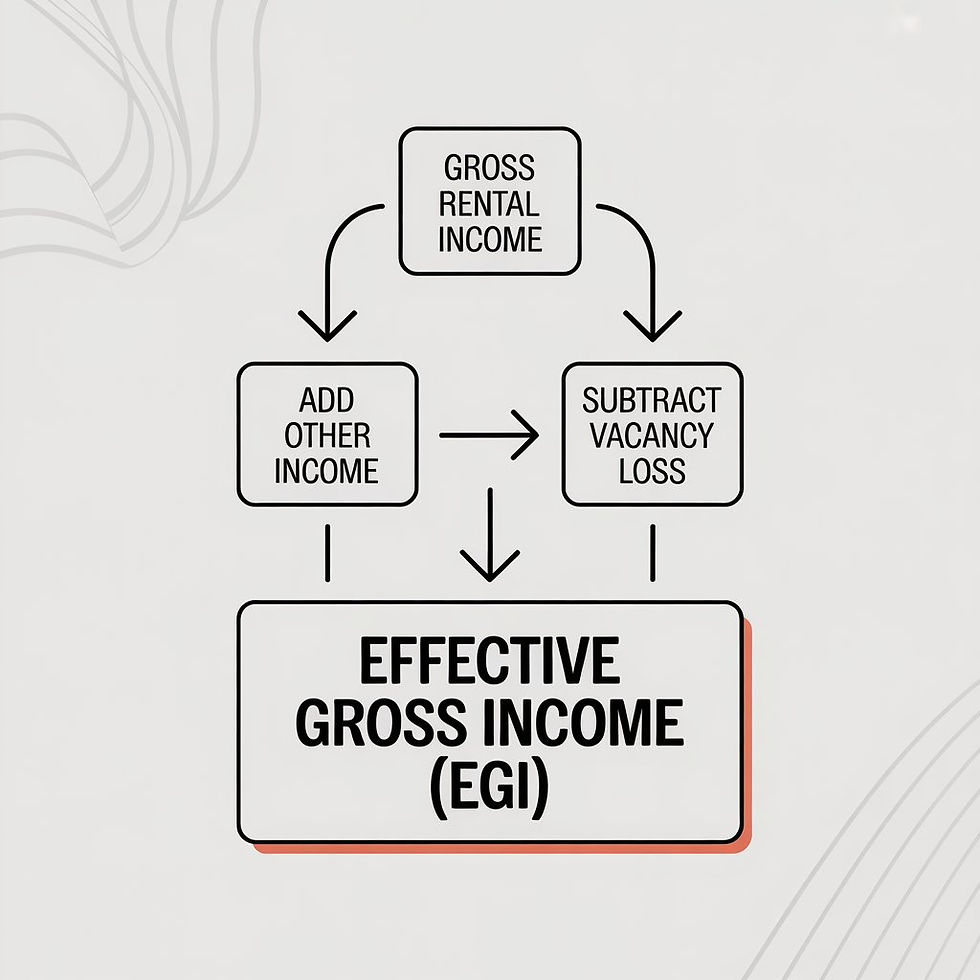

1. Use Accurate NOI Figures

Include all reliable income sources (rental income, parking fees, storage fees, late fees, vending machines, etc.).

Deduct all operating expenses (property taxes, insurance, repairs, property management fees, utilities, and maintenance costs).

Exclude financing costs (mortgage payments and loan interest) since cap rate evaluates the property’s performance before debt service.

2. Verify the Purchase Price

Use either the actual purchase price or the current fair market value of the property.

Compare with recent sales of similar properties in the same area to confirm accurate valuation.

Consult with real estate appraisers and brokers for additional insights.

3. Consider Market Conditions

Cap rates fluctuate based on economic trends, interest rates, inflation, rental market demand, and local real estate cycles.

Evaluate historical and projected cap rates for similar properties to anticipate future performance.

Analyze vacancy rates, tenant turnover, and economic growth in the area.

4. Compare Across Similar Properties

Only compare cap rates of similar property types (e.g., multifamily vs. multifamily, retail vs. retail).

Consider location, property condition, tenant quality, and lease terms when evaluating different properties.

Look at Class A, Class B, and Class C properties separately as they have distinct risk and return profiles.

5. Account for NOI Growth and Future Expenses

Factor in potential rent increases based on market demand, job growth, and neighborhood development.

Account for future expenses such as renovations, major capital expenditures, insurance premium increases, and tax reassessments.

Conduct a sensitivity analysis to understand how changes in NOI impact the cap rate.

Pros and Cons of Using Cap Rate in Real Estate Investing

Pros:

✅ Quick Investment Comparison – Cap rates allow investors to evaluate multiple properties efficiently.

✅ Measure of Risk & Return – Higher cap rates suggest higher risk but greater potential returns, while lower cap rates indicate stability.

✅ Market Benchmarking – Helps assess whether a property is competitively priced in the market.

✅ Objective Evaluation – Provides a standardized method to analyze income-generating properties.

✅ Applies Across Asset Classes – Useful for evaluating commercial real estate, multifamily properties, and retail spaces.

Cons:

❌ Ignores Financing Costs – Cap rates do not factor in mortgage payments or interest rates, which are crucial for leveraged investments.

❌ Sensitive to Market Fluctuations – Economic conditions can cause cap rates to fluctuate, making long-term comparisons challenging.

❌ Doesn’t Consider Property Appreciation – Cap rate only evaluates current income vs. purchase price, excluding potential property value growth.

❌ Oversimplifies Investment Decisions – Other key factors such as location, tenant stability, property management efficiency, and rent potential should also be considered.

❌ No Standardization – Cap rate calculations can vary based on what income and expenses are included. Investors should rely on their market expertise and verified data.

Final Thoughts: Cap Rate as a Real Estate Investment Tool

The capitalization rate is a valuable metric for real estate investors, property developers, and commercial real estate professionals to analyze properties, compare investment opportunities, and assess risk vs. return. However, it should be used alongside other financial metrics such as cash-on-cash return, internal rate of return (IRR), debt service coverage ratio (DSCR), and property appreciation potential to make well-rounded investment decisions.

Additional Resources for Real Estate Investors

By mastering the cap rate calculation and incorporating it into your real estate investment strategy, you can identify high-performing properties, maximize returns, and build a successful real estate portfolio in today’s competitive market.

This blog post is provided for informational purposes only and should not be construed as financial, legal, or investment advice. While I am a licensed real estate professional in New York, I am not a financial advisor, attorney, or tax professional. Readers are strongly encouraged to consult with their own licensed attorney, CPA, or financial advisor before making any real estate investment decisions. All information is deemed reliable but not guaranteed and is subject to change based on market conditions, legal updates, or individual deal circumstances.

Comments