Effective Gross Income (EGI) Explained: NYC Investors' Guide to Measuring Rental Property Income

- gary wang

- Jun 2, 2025

- 3 min read

💰 What Is Effective Gross Income (EGI) in Real Estate?

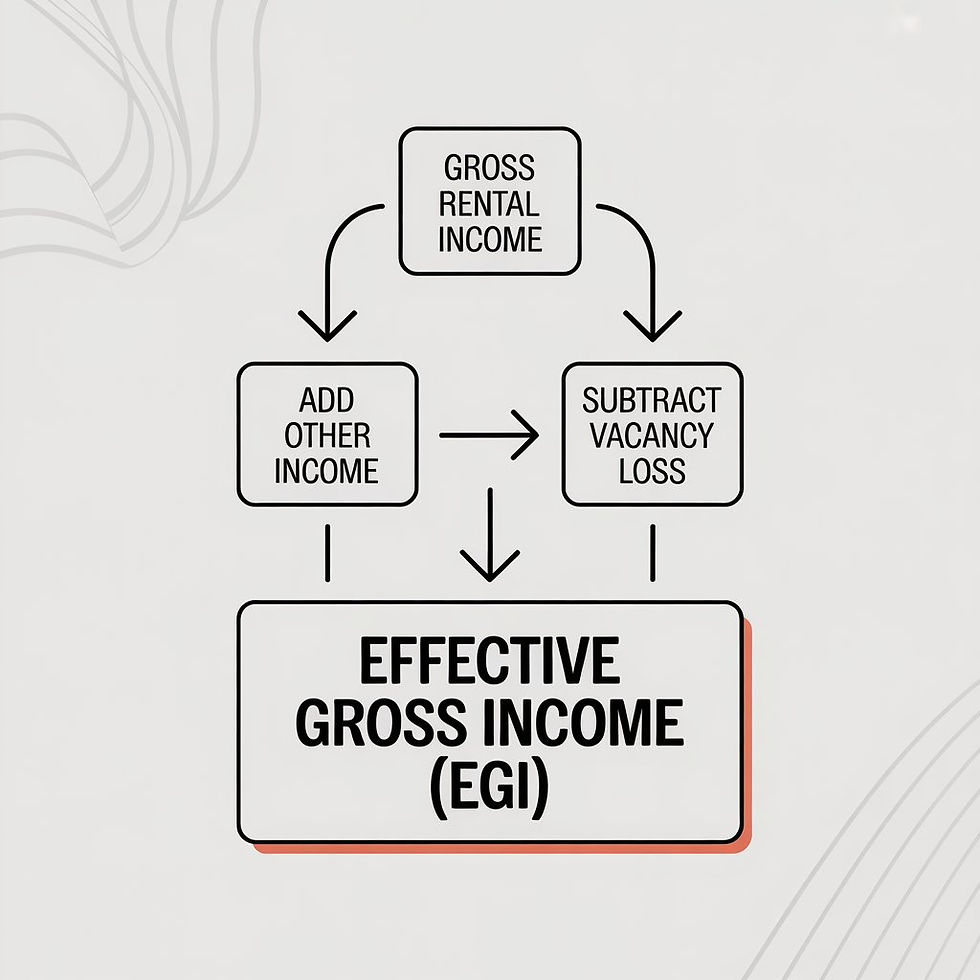

For new NYC real estate investors, understanding your Effective Gross Income (EGI) is essential to evaluating a rental property's true earning potential. While gross income might look good on paper, it doesn’t account for real-world factors like vacancy or missed rent. That’s where EGI comes in.

EGI = Potential Gross Rental Income + Other Income – Vacancy Loss

🧠 Why EGI Matters for NYC Real Estate Investors

In a complex and competitive market like New York City, EGI helps you see how much cash flow your property can realistically generate each month. This matters because:

Banks use EGI to underwrite commercial real estate loans

Investors use it to compare deals and forecast returns

It accounts for real-world income fluctuations, including vacancies, late rent, and extra revenue like laundry or parking

EGI is the foundation of most real estate income calculations—especially Net Operating Income (NOI) and Cap Rate.

🏢 How to Calculate EGI: Step-by-Step

Let’s break it down with an NYC multifamily example:

Potential Gross Rental Income:

4 units renting at $2,500/month = $10,000/month or $120,000/year

Other Income:

Laundry machines bring in $150/month = $1,800/year

Vacancy Allowance:

5% estimated vacancy = 5% of $120,000 = $6,000

EGI = $120,000 + $1,800 – $6,000 = $115,800

💡 What’s Included in EGI?

Effective Gross Income (EGI) includes:

✅ Included:

Monthly or annual rent income (stabilized or projected)

Other income streams: laundry, storage, parking, vending machines

Adjustments for anticipated vacancy or credit loss

❌ Not Included:

Operating expenses (utilities, taxes, repairs)

Debt service (mortgage payments)

💡 Think of EGI as your top-line income after realistic adjustments—but before operating costs.

📉 How Vacancy and Income Trends Affect EGI in NYC

NYC’s rental market can be highly seasonal and sensitive to economic shifts. Here are some factors that influence your EGI:

Market volatility: Sudden rent drops or job losses can spike vacancy

Rent stabilization laws: Limit how much income can be increased year-over-year

Local competition: Oversupply of units in an area can push your vacancy rate up

Extra services: Offering premium storage, AC units, or bike parking can boost “other income”

Conservative estimates of EGI are typically used during underwriting to reflect downside risks.

🧮 EGI vs. Gross Income: Know the Difference

Metric | Includes Vacancy? | Includes Other Income? | Use Case |

Gross Income | ❌ No | ❌ No | Basic rent analysis |

Potential Gross Income | ❌ No | ✅ Yes | Max rent possible |

Effective Gross Income | ✅ Yes | ✅ Yes | Realistic income used for valuation |

📈 Why EGI Is Critical for NYC Investors

Used to calculate NOI: NOI = EGI – Operating Expenses

Determines Cap Rate: Cap Rate = NOI / Property Value

Helps with DSCR analysis: DSCR = NOI / Debt Service

Without understanding EGI, any calculation of return on investment (ROI), cap rate, or cash flow is incomplete or inaccurate.

🏁 Don’t Skip EGI in Your Investment Math

For NYC real estate investors, Effective Gross Income is a foundational number. It brings your expectations closer to reality by factoring in vacancies and alternative income, ensuring you don’t overpay or overestimate returns. Whether you're buying a walk-up in Astoria or a brownstone in Bed-Stuy, calculating EGI properly keeps your investment grounded and profitable.

Comments