🏠 NYC Real Estate 101: Why Multi-Family Homes Are the Smart Start for New Investors

- gary wang

- May 7, 2025

- 3 min read

🔍 What Is a Multi-Family Home?

A multi-family home is a residential property that contains two or more separate units, each with its own living space. These can range from simple duplexes to large apartment complexes, and everything in between. In NYC, they're a popular investment option due to the city’s dense population, high rental demand, and appreciating property values.

📍Common Types of Multi-Family Homes in NYC:

Duplex or Triplex: Typically found in Brooklyn and Queens, often converted from old row houses.

Brownstones with multiple rental floors: Especially in Harlem, Bed-Stuy, and Park Slope.

Walk-up buildings (4-6 units): Common in Manhattan and the Bronx.

Garden-style apartments: Often found in outer boroughs like Staten Island.

💰 Why New Investors Should Consider Multi-Family Homes

📈 Steady Cash Flow

Each unit produces rental income, which can cover your mortgage and operating expenses—even if one unit is temporarily vacant.

🧠 Easier Path to Wealth

Multi-family homes allow you to build equity faster. As you pay down the mortgage with rental income, you gain ownership over an appreciating asset.

🧾 Tax Benefits

You can deduct mortgage interest, repairs, depreciation, property management fees, and even some travel expenses.

🏡 House Hacking

Live in one unit and rent the others. This is a popular entry point for NYC investors using FHA or VA loans with as little as 3.5% down.

🗺️ NYC Zoning: What You Need to Know

Zoning laws dictate how many units are legally allowed on a lot.

🔑 Key Zoning Terms:

R3–R10: Common multi-family residential zones.

FAR (Floor Area Ratio): Dictates how much space you can build relative to your lot size.

Density limits & setbacks: Impact how many units you can legally operate.

💡 Pro Tip: Never assume a building with multiple units is legal without checking its Certificate of Occupancy.

💸 Financing Multi-Family Homes

🏦 Residential Loans (2–4 units):

FHA Loans: Only 3.5% down with owner occupancy.

Conventional Loans: 15–25% down, better terms with higher credit.

🏢 Commercial Loans (5+ units):

Higher rates, strict underwriting.

Based on property’s net operating income (NOI), not personal income.

📌 What Lenders Look For:

Credit score (620+ minimum, 700+ ideal)

Debt-to-income ratio

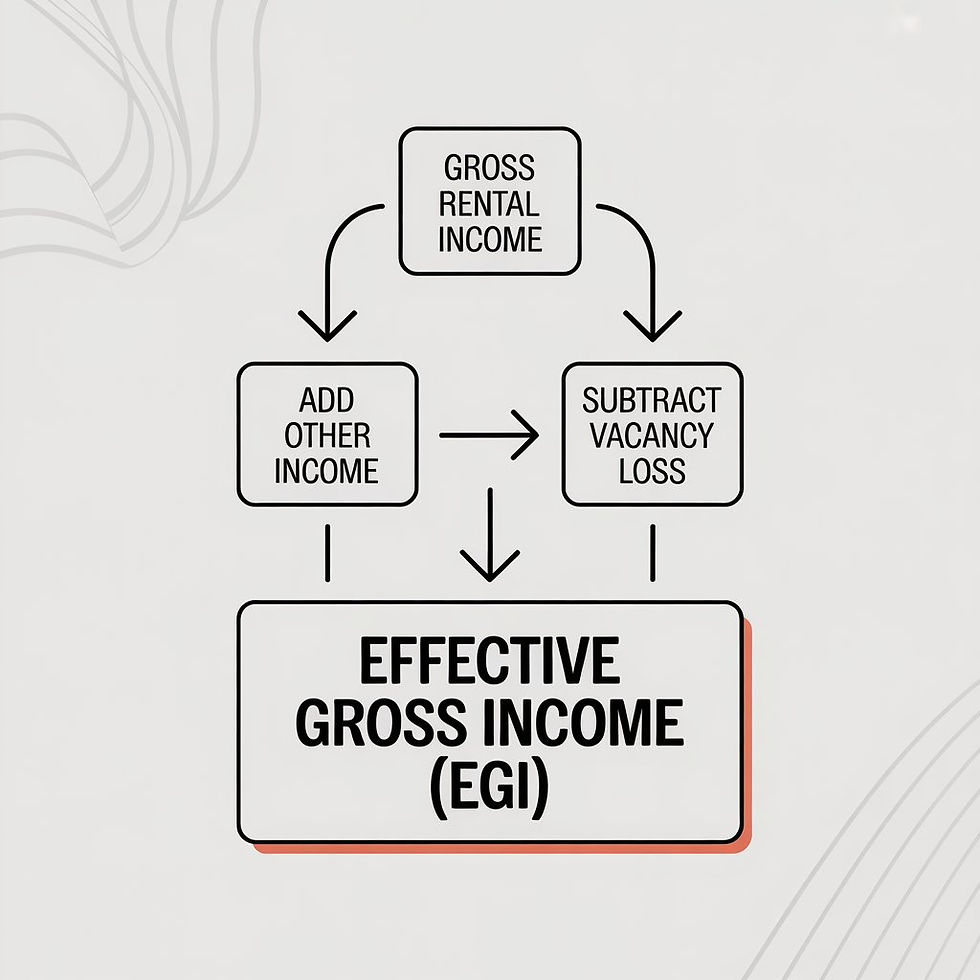

Rent roll or projected income

Property condition and location

🛠️ Responsibilities of Owning Multi-Family in NYC

Being a landlord in NYC comes with legal obligations and regulatory compliance:

🧾 Legal Compliance:

Must register with HPD (Housing Preservation and Development)

Follow rent stabilization and habitability laws

Required annual inspections for larger buildings

🔧 Property Management Tasks:

Collect rent

Handle repairs and maintenance

Screen tenants

Comply with NYC fire and housing codes

💡 New to this? Hire a licensed property manager or start small and self-manage your first building.

📈 Long-Term Wealth Through Multi-Family Investing

Example: The Brooklyn Triplex Strategy

You purchase a $1.2M triplex in Crown Heights:

Live in one unit

Rent the other two for $2,800 each

After mortgage, taxes, and insurance, you cash flow $800/month while building equity

Fast forward 5 years:

You refinance

Use the equity to buy your second multi-family in Queens

Scale your portfolio, repeat the process

✅ Final Thoughts: Should You Buy a Multi-Family in NYC?

If you're ready to:

Generate consistent rental income

Grow a long-term asset

Live affordably while investing

Then multi-family homes are one of the most accessible and powerful tools available to new NYC real estate investors. They offer the perfect mix of income, stability, and scalability.

Comments